Some NHS Trusts have been advised in the past that where an invoice shows separate lines for different elements of a supply, these invoices cannot be apportioned or ‘split’ in order to recover VAT on the eligible COS part.

Although this may be true in some respects, this is not always the case as each supply and invoice needs to be considered on its own merits.

The aim of this newsletter is to clarify this point for our NHS clients and prospects in order to help maximise COS VAT recovery. Although not exhaustive, we have set out below some circumstances where it may be permissible to partially recover VAT on invoices for COS VAT recovery purposes.

Background – Single or Multiple Supply?

There have always been problems in determining the correct VAT treatment of transactions consisting of separately identifiable goods or services and whether there is a single supply or a multiple supply made up of several elements. Usually, the problem concerns the VAT liability of supplies (e.g. standard-rated or zero-rated), however the same principle applies to whether VAT can be claimed or not on all or part of a supply.

VAT legislation provides no real rules on this point, so over the years tribunal and court decisions have produced general guidelines, the most persuasive of which is the ECJ decision in Card Protection Plan Ltd. The key points from this case are:

- Regard must be paid to all the circumstances in which the transaction takes place.

- Each supply of a service must normally be regarded as distinct and independent but a supply that comprises a single service from an economic point of view should not be artificially split – the essential features of the transaction must be ascertained to decide if the supply to a typical customer comprises several distinct services or a single service.

- There is a single supply in cases where one or more elements are to be regarded as ancillary services. An ancillary service is defined as something that does not constitute for customers an aim in itself but is a means of better enjoying the principal service supplied.

- The fact that a single price is charged is not decisive. If the circumstances indicate that customers intend to purchase two or more distinct services a single price will not prevent these being treated as separate supplies with different liabilities applying to those services.

Application to COS VAT

Considering the above criteria, where a mixed supply is evident and certain elements are for services which are eligible for recovery under COS, the VAT on that element can be recovered.

Conversely, where a single supply is evident, it would be correct to treat the VAT according to the principal element. If the principal supply is not eligible for recovery (e.g. goods), then none of the VAT should claimed. If the principal supply is eligible for recovery (e.g. repair services involving fitting new parts), then all of the VAT can be claimed. The COS Treasury Direction does in fact state that VAT recovery is eligible on listed ‘services and closely related goods’, which allows VAT recovery in these circumstances.

Examples of Mixed Supplies Where Part of the VAT Can be Recovered

Given the circumstances, there cannot be a definitive list of what supplies can or cannot be apportioned, however examples agreed with HMRC include:

- Where an NHS body purchases equipment, any maintenance service supplied is recoverable when either supplied by the same supplier or a separate supplier. In these circumstances, the maintenance usually could have been purchased optionally or able to be purchased as a stand-alone service. This would indicate that it is permissible to recover VAT on the maintenance part of such invoices if separately itemised.

- Orthotic supplies – VAT on repairs and or adaptations to existing patient appliances is recoverable if the supply is primarily one of services as opposed to goods. Also, HMRC have agreed to VAT recovery on the repairs/adaptation element of invoices containing mixed supplies. The supply of bespoke footwear, appliances, wheelchairs specifically designed for a patient is not recoverable as this is considered a supply of goods.

- Capital schemes with elements of building repairs, cleaning or waste disposal. In these circumstances, HMRC specifically allow VAT recovery on a proportion of invoices, either using a line-by-line analysis, or by applying a published banding percentage. The invoices need not be itemised for apportionment to still apply.

- If a printing supplier includes printed documents and standard stationery on the same invoice, it is permissible to treat the printed items as a separate supply and recover the VAT on this element, again, if separately itemised.

Examples of Single Supplies Where Invoices Should Not Usually be Split

- Supplies of goods with itemised delivery – these are single supplies of delivered goods and no VAT is eligible for recovery under COS. The issue of delivery costs as being ancillary to the principal supply is well tested in the courts.

- On leases of equipment, it is usually possible to include or exclude the maintenance at the outset of a lease depending upon the customer’s requirements. However, where an NHS body leases equipment, any maintenance service supplied is only recoverable if the maintenance is from a separate supplier, (apart from hire of vehicles and photocopiers when all the VAT is recoverable where maintenance is part of the supply).

- IT equipment with training, consultancy, etc – if the training relates merely to being shown how to use the equipment when initially purchased or leased, HMRC would consider the training element to be part of the one supply of equipment and cannot be split out. IT consultancy is recoverable but if it is inherent to the supply of software or hardware then it may not be recoverable and the whole nature of the supply will need to be considered.

- Supplies of cleaning services with consumables – in these circumstances, the cleaning company is using the consumables to provide cleaning services, so the whole supply is eligible for recovery under COS including the consumable goods.

Summary

To summarise, it is certainly possible to apportion invoices for COS VAT recovery in many circumstances, but regard must be paid to the nature of the supply.

If your Trust has be advised not to recover VAT on a proportion of invoices under any circumstances, CRS VAT Consulting would be interested in helping you to achieve the correct VAT recovery going forward.

In an article from November 2010, we informed you about the introduction of VAT penalties for the NHS for the first time from April 2011.

To re-cap, the penalties are designed so that if a taxpayer takes ‘reasonable care’ when completing a return, they will not be penalised for an error. The penalties could range between 15% and 100% of the VAT but can be reduced or eliminated depending upon whether the error is voluntarily disclosed before HMRC discovers it (unprompted) or after HMRC makes enquiries (prompted).

HMRC are still yet to provide any further guidance on how they are going to apply the penalties in respect of the specific NHS rules, in particular contracted-out services (”COS”) VAT. We have been told that further guidance is imminent and we will share this with our clients as soon as this happens.

In order to be prepared going forward, we believe it would be prudent to ensure that robust systems and procedures are in place to ensure that any VAT errors are minimised and disclosed where necessary.

What is ‘Carelessness’?

HMRC’s expectation is that taxpayers will take reasonable care in ensuring tax returns, reclaims and dealings with HMRC are correct.

Whether a taxpayer has acted carelessly is somewhat subjective and will depend upon the circumstances, however the following are all possible examples of carelessness:

- Failure to keep records

- Failure to seek appropriate advice

- Failure to supply relevant information to a VAT adviser

- Failure to implement adequate procedures or systems to produce accurate tax information

- Estimating amounts entered on returns

- Not checking for implementation and failures in planning/technical areas

Taking Reasonable Care – Further Recommendations for you to Adopt

Taking and acting upon advice from a competent and qualified expert is generally considered to be taking reasonable care.

As a matter of course, if not already in place, we would recommend all NHS bodies to set up a permanent electronic and paper file of all internal VAT procedures, HMRC correspondence and VAT advice.

This should include:

- Written procedures for completion of the VAT return

- A robust written procedure for making VAT journal adjustments to ensure that these are compliant with the penalty regime

- Written procedures for identifying all purchases from outside the UK and application of the reverse charge VAT procedures. We can provide free helpline advice on this topic

- Copies of all letters to and from HMRC (e.g. regarding business and partial exemption approvals, capital VAT approvals over £50,000, options to tax, etc)

- Copies of all VAT review findings and adjustments, VAT advice received and VAT newsletters.

In addition, the following actions should also be undertaken:

Review all sales and cash income to ensure that the correct VAT liability is applied. We have produced a checklist of all of the main areas of income generation and the current VAT liability to be applied. This should cover most areas, but if there are any areas of income generation which you are still unsure about, we would be happy to advise.

Ensure that any VAT recovery on capital projects meet HMRC requirements and any banding percentages used are justified. Also ensure that any capital schemes where VAT recovery exceeds £50,000 are disclosed to HMRC.

Ensure that any current or anticipated land and property transactions are considered for VAT purposes and ensure that any option to tax notifications are recorded, complied with and kept with the permanent VAT file.

Where you have exempt business income (e.g. private patient care or property rental) ensures that the partial exemption calculations and submissions are completed on time.

Review of any existing managed healthcare facility or managed laboratory contracts to ensure correct VAT treatment.

Review of any non-NHS third party arrangements where there are potential VAT issues (e.g. S75 agreements, other arrangements with local authorities, prisons, universities, charities or social enterprise companies).

Penalty Mitigation by Disclosure to HMRC

The potential penalties can be mitigated depending upon the timing and level of disclosure of errors and the level of co-operation with HMRC. There is a greater reduction for “unprompted” versus “prompted” disclosure. An unprompted disclosure is made at a time when a taxpayer has no reason to believe HMRC had discovered or were about to discover the inaccuracy concerned.

It must be noted that correcting an error in the next VAT return is not disclosure.

At present, there is no requirement to submit COS VAT adjustments to HMRC for their prior approval before adjusting the VAT return. HMRC have not yet said whether this would change from April, however under the normal commercial VAT rules, net errors not exceeding the greater of £10,000 or 1% of turnover, subject to an upper limit of £50,000, can be adjusted on a current VAT return.

If the error was caused by a failure to take reasonable care (or there is any doubt on this point) a separate disclosure may be necessary (or prudent) to ensure penalty mitigation.

The standard rate of VAT is due to rise again from 17.5% to 20% on 4 January 2011. This rise in VAT may encourage NHS organisations to make large value purchases in December 2010 rather than in January 2011, but there are other ways to ensure that the lower rate of VAT is applied where possible to supplies.

As NHS bodies are unable to recover all of the VAT they incur, the correct application of the rules should be considered to avoid any unnecessary costs.

Below are various transactions which your NHS body may be involved in during the period of the rate change. A special set of transitional rules are available to enable relief from the charge to VAT at 20% in particular circumstances.

Supplies Made and Invoiced for / Paid for Prior to 4 January 2011

The provision of goods and services prior to the 4 January 2011 deadline, which are invoiced for or paid for prior to that date, will be subject to VAT at the current standard rate of 17.5%.

Supplies Made on or after 4 January 2011 but Invoiced or Paid for in Advance

Where services or goods are invoiced for or paid for in advance, the VAT rate usually applies according to the date of the invoice/payment under the normal ‘tax point’ rules. Therefore, if a supplier raises an invoice prior to 4 January or your NHS body pays in advance for goods or services supplied from 4 January 2011, the 17.5% VAT rate can still apply.

It may therefore be advisable to arrange for pre-payments in relation to certain supplies due to be made after the rate change to trigger a lower tax point at 17.5%, however, commercial risks, cashflow issues and ‘anti-forstalling’ legislation should be considered beforehand.

In certain circumstances, the ‘anti-forestalling’ legislation introduces a supplementary charge of 2.5% VAT which limits the extent to which a benefit can be obtained by applying the 17.5% rate to supplies of goods or services provided on or after 4 January 2011.

Supplies Made Before 4 January 2011 but Invoiced from 4 January 2011

Under the normal rules, a VAT invoice issued on or after 4 January 2011 (usually within 14 days) which relates to work completed before that date will be chargeable to VAT at 20%. This also applies to any retention payment received on or after 4 January 2011. However, the special change of rate rules can be applied in this situation.

If a supplier issues a VAT invoice on or after 4 January 2011 for transactions completed before 4 January 2011, it may, if it wishes, apply the 17.5% rate. The supplier may decide to apply these rules even after it has issued a VAT invoice showing 20% VAT. If it does, it must issue a special credit note giving credit for the extra 2.5% VAT within 45 days of the rate change (i.e. by 18 February 2011). The original invoice should not be cancelled. The special rate change rules apply to the provision of goods as well as services.

Your NHS body may have entered into a construction contract (which may include design, advisory and supervisory services) which requires it to make stage payments. Under the normal rules, if your NHS body continues with work under a stage payment contract on 4 January 2011, any VAT invoices it receives or payments it makes on, or after, that date will be liable to VAT at 20%. However, the special change of rate rules can be applied by your supplier if it issues a VAT invoice or receives a payment (including retention or final account payments) covering work actually performed before 4 January 2011. This enables VAT to be charged at 17.5% on the work performed up to midnight 3 January 2011. (VAT will be chargeable at 20% for work completed after this date).

Work in Progress on 4 January 2011

Your supplier may be carrying out a service which commences before 4 January 2011 and is still in progress after that date. The normal rule is that where an invoice is issued or a payment received after 4 January 2011, VAT is chargeable at 20%, even if part of the supply was undertaken before that date.

The special rules enable the element of work performed before 4 January 2011 to be charged at 17.5%, (including retention or final account payments). An apportionment of the value of the transaction should be made by the supplier (based on measurable work or normal costing or pricing structures).

Continuous Supplies

If your supplier provides goods or services on a continuous basis and receives payments regularly or from time to time, it must declare VAT to HMRC (the tax point) every time it issues a VAT invoice; or receives a payment (whichever happens first). Under the special change of rate rules, it may account for VAT at the 17.5% rate on that part of the supply made before 4 January 2011. This is the case, even if the normal tax point occurs later (for example, where a payment is received in arrears of the supply).

If the supplier decides to do this, it should account for VAT at 17.5% on the value of the goods actually supplied or services actually performed before 4 January 2011. After this date, it must account for VAT at 20% on the value of the goods actually supplied or services actually performed. This may represent a significant cost saving for NHS bodies receiving such supplies, given that they may be unable to recover all the related VAT.

Example

A supplier leases beds to a hospital for £5,000 per month plus VAT. It invoices quarterly in arrears. What VAT should the supplier charge for the quarter covering 1 November 2010 to 31 January 2011?

The normal rule is that VAT should be charged at 20% on the entire £5,000 fee because the invoice is issued after 4 January 2011. However, if a supplier so wishes it can charge VAT at 17.5% on the amount due for from 1 November to 3 January. As the hospital is not generally able to recover the VAT, using the special rules will result in a VAT saving.

Single Supplies Carried Out Over a Period of Time

A supplier may make a single supply of a service which is carried out over a period which commences before 4 January 2011 but is not completed until after that date. Unless the supplier has received payment or issued a VAT invoice before 4 January, the whole supply should be charged at the 20% rate under the normal rules.

However, if the supplier wishes it may charge VAT at 17.5% on the work done before 4 January 2011 and 20% on the remainder. The supplier will have to demonstrate to HMRC that the apportionment between the two amounts accurately reflects the work done in each period.

Example

A hospital subscribes to a web-based information provider from 1 October 2010 to 31 March 2011. How does the hospital calculate the VAT?

The web-based information provider may account for VAT at 17.5% on the website access provided before 4 January 2011 and 20% on the remainder. It will need to be able to show that its calculation is accurate – perhaps by maintaining a usage log to demonstrate this.

Income Generation

The same rules as above apply to business supplies made by NHS bodies.

You need to ensure that your own accounting systems and staff responsible for debtor income, cash income and income generated from staff salary deductions are prepared to charge VAT at 20% on appropriate business supplies from 4 January 2011.

Where VAT is calculated on gross income receipts (e.g. car parking or catering), the fraction used to calculate the VAT will need to be changed from 7/47ths (for 17.5% VAT) to 1/6th (for 20% VAT).

With the VAT rate increase to 20% and the introduction to the NHS of penalties and interest on VAT errors from 1 April 2011, it is more important than ever to ensure that the correct VAT liability is applied to business income generation. Please visit our website at www.crsvat.com to download a business income VAT liability table showing the VAT rate for common business supplies of NHS bodies.

HMRC have heralded a major change to the NHS VAT rules by announcing their intention for the first time to apply ‘penalties for VAT infringements’ for periods beginning on or after 1 April 2011.

There have always been penalties for VAT errors made by other taxpayers but these have never before been implemented in the NHS. The recent introduction of a new penalty regime for all taxpayers has however caused HMRC to conclude that the NHS should be treated no differently.

What are the penalties?

There are a range of VAT penalties for different types of infringement, however the main penalties are for incorrect VAT returns, which can apply where a VAT return contains either a ‘careless’ or ‘deliberate’ inaccuracy (action) which leads to an understatement or over-claim of VAT.

These penalties are designed so that if a taxpayer takes ‘reasonable care’ when completing a return, they will not be penalised for an error, however the definition of reasonable care can vary depending upon the person, their circumstances and their abilities. These can be reduced or eliminated depending upon whether the error is voluntarily disclosed before HMRC discovers it (unprompted) or after HMRC makes enquiries (prompted).

Penalties are expressed as a percentage of the potential lost revenue and can be summarised as follows:

| Reason for penalty | Penalty | Possible reduced penalty for unprompted disclosure | Possible reduced penalty for prompted disclosure |

| Careless action – failure to take reasonable care | 30% | 0% | 15% |

| Deliberate but not concealed action | 70% | 20% | 35% |

| Deliberate and concealed action | 100% | 30% | 50% |

| Error in HMRC assessment | 30% | 0% | 15% |

There are other penalties which may apply for other infringements including such things as issuing incorrect certificates, however HMRC have yet to provide any detailed guidance on how and which of the penalties will be levied to the NHS.

What this Means to the NHS

With the introduction of penalties, it will be more important than ever to have robust and documented VAT procedures in place for the correct accounting of VAT and preparation of VAT returns.

The penalty regime will certainly apply to input tax and output tax errors, so it will be important to ensure that the correct VAT liability is recorded for all business transactions.

Although little detail has been provided to-date, we have also been told that HMRC see no reason why the penalty regime wouldn’t apply to contracted-out services (“COS”) VAT errors, i.e. VAT claimed incorrectly under the COS rules.

There are still quite a few questions unanswered such as whether COS VAT corrections will require ‘disclosure’ to HMRC, or whether the annual June deadline for COS VAT will be extended to four years to allow a ‘level playing field’ for the correction of COS VAT underclaims and overclaims.

We will therefore provide further updates once this information is known.

The ECJ has recently given its judgement on questions from the UK VAT Tribunal in the case of Astra Zeneca, which provided employees with retail vouchers as part of their remuneration.

Astra Zeneca argued that input tax on the purchase of these vouchers should be recoverable as a business overhead but that no VAT was due on the supply of the vouchers as there was no consideration for the supply.

The ECJ found that provision of the vouchers is an economic activity and is a supply of services. They also concluded that the consideration for this supply is the part of the cash remuneration given up by the employee in return for the voucher and that output tax is due on that consideration.

This judgement is likely to lead to a change to the current VAT treatment of benefits provided by employers to employees under salary sacrifice arrangements, whereby output tax will become due on the supply of various types of salary sacrifice benefits which would otherwise be taxable supplies for VAT purposes. The decision could affect types of benefit provided under such schemes as:

- Workplace car-parking

- Cycle schemes

- Lease cars

- Mobile phones

The supply of benefits which would normally be exempt from VAT, such as childcare vouchers, should remain unaffected by the ECJ’s judgement. ‘Bus’ schemes will not be affected because they are zero rated for VAT purposes. Workplace nurseries are also unlikely to be affected since activities undertaken within them are typically exempt for VAT purposes.

Potential Effect on the NHS

Where salary sacrifice schemes such as cycle to work schemes or car-parking have been entered into by NHS bodies, VAT may now become due. However, if any NHS Trusts have historically disallowed input tax on associated purchases of salary sacrifice benefits, this VAT would subsequently become recoverable as business input tax.

This change in VAT treatment may not therefore have any material effect in circumstances where benefits have been charged on ‘at cost’ including the VAT cost, as the revised treatment of declaring output tax and recovering input tax would effectively be cost neutral. This change may however have an adverse effect on benefits where there is little if any input tax to recover, such as staff car-parking.

We will provide more detailed guidance when HMRC confirm how the Astra Zeneca decision should be applied. In the meantime, NHS bodies should review their existing salary sacrifice schemes and flexible benefit schemes to see if the benefits provided are subject to VAT. They should also:

- ensure that any proposed schemes are planned to take account of the potential additional VAT costs

- consider if they will bear the full burden of the additional VAT cost or ask employees to bear all or some of the cost

- note that any increased salary deductions may require changes to employment contracts and will have tax consequences

- consider changing the range of benefits available to mitigate the VAT cost

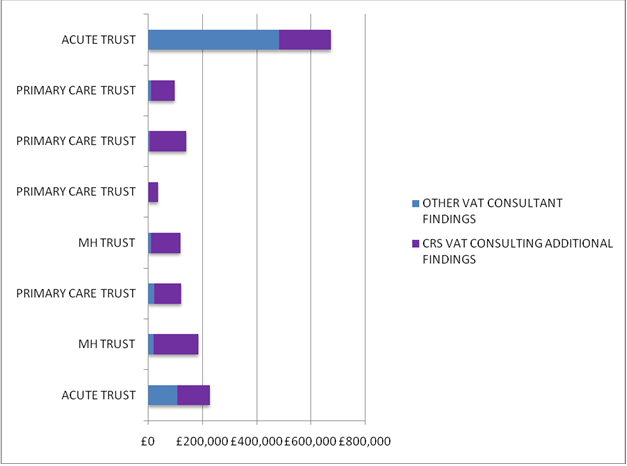

By reviewing the exact time periods and types of VAT as our main competitor, we produce substantial additional results.

The following table represents just eight of the latest contracted-out services (“COS”) VAT re-reviews which we have completed for the first nine months of 2009/10 (April to December) where the previous adviser had already carried out their VAT review.

On average, we have identified £140,000 more VAT recovery than the previous adviser.

Don’t forget that there is an annual deadline of the end of June 2010 to make sure that any COS VAT for the 2009/10 year is claimed, so please contact us as soon as possible in order to arrange a re-review.

NHS bodies should be aware of a newly published concession which may lead to a decrease in VAT being charged on nursing services which is currently eligible for recovery under the Contracted-Out Services (“COS”) rules.

HMRC have now permitted nursing agencies (or employment businesses providing nurses, midwives, and other health professionals) to exempt the supply of nursing staff and nursing auxiliaries supplied to an NHS body (provided that they are registered with an organisation approved by HMRC).

Qualifying suppliers providing nursing auxiliaries or care assistants may use the concession if the individuals they place undertake some direct form of medical care (such as administering drugs or taking blood pressures, for the final patient). However, the concession does not apply to supplies of general care assistants who are only involved in providing personal care such as catering, washing or dressing the patients.

In some cases, it may be in the interests of nursing agencies to continue to charge VAT, rather than to exempt their supplies.

For example, certain nursing agencies may be taxable businesses which are able to recover 100% of the VAT which they incur in respect of nursing and auxiliary staff which they supply (because they are supplied subject to VAT). Therefore, they may feel that their own VAT recovery will be restricted by adopting the concession to certain services. This is likely to lead to an increase in the costs to their NHS clients because of the irrecoverable VAT costs. As a result, there may be scope for certain NHS bodies to ask such agencies to continue to charge VAT on certain services described above. If the agencies agree, then NHS bodies may continue to recover the VAT on the costs of supplies of nursing and auxiliary services which they incur, (until at least the COS rules change).

If you would like further details regarding this concession, and the impact it may have on your NHS body’s recoverable VAT, please do not hesitate to contact us.

As stated in the article above, it is common knowledge that NHS bodies are able to recover VAT incurred on supplies of nursing staff (including qualified and non-qualified nurses/healthcare assistants) under COS heading 41 and admin/clerical grade staff (including receptionists, secretaries, etc) under COS heading 69.

However, in respect of temporary placements of health professionals described as ‘ODP’s’ and ‘ODA’s’, HMRC have recently sought clarification from their policy unit and have taken the view that the related VAT incurred by an NHS body is not recoverable.

We are currently seeking further clarification on this point, given that we understand these acronyms are in fact considered by many as nursing staff grades.

Following on from the submission of Fleming/Conde Nast VAT claims (the first anniversary of the 31 March 2009 deadline having now come and gone), the claims submitted on behalf of NHS bodies still appear to have a long way to go before they are settled.

At present, HMRC have stated that both the ‘Lennartz’ and ‘Wellington/BUPA’ elements of the Fleming claims are invalid. This is because in HMRC’s view, subsequent case law has meant that the decisions in these cases were either wrong or have been superseded.

HMRC invited CRS VAT Consulting along with other representative claimants to a meeting in London a few weeks ago to explain their decision on the Wellington/BUPA drugs issue with a view to finding some ‘common ground,’ however the obvious intention was to dissuade any claimant from taking the issue any further. It is however likely that at least one rejected claimant may submit a formal appeal to the VAT Tribunal.

Other elements of certain claims are still technically valid (e.g. prescription drugs, other drug sales, catering, etc), however HMRC have still not yet decided on the issue of whether the claimant Trusts or the SHAs have the right to pre-Trust claims. Until this issue is resolved, these elements of claims which are technically valid are also being held up.

In our last VAT report, we advised that the new procedures for compulsory online VAT return filing were not yet available to the NHS. HMRC have since stated that online filing will be applicable to the NHS, however the issue of how to file the accompanying VAT21 Form does not yet appear to have been resolved. We will therefore keep you informed as soon as further guidance is available.